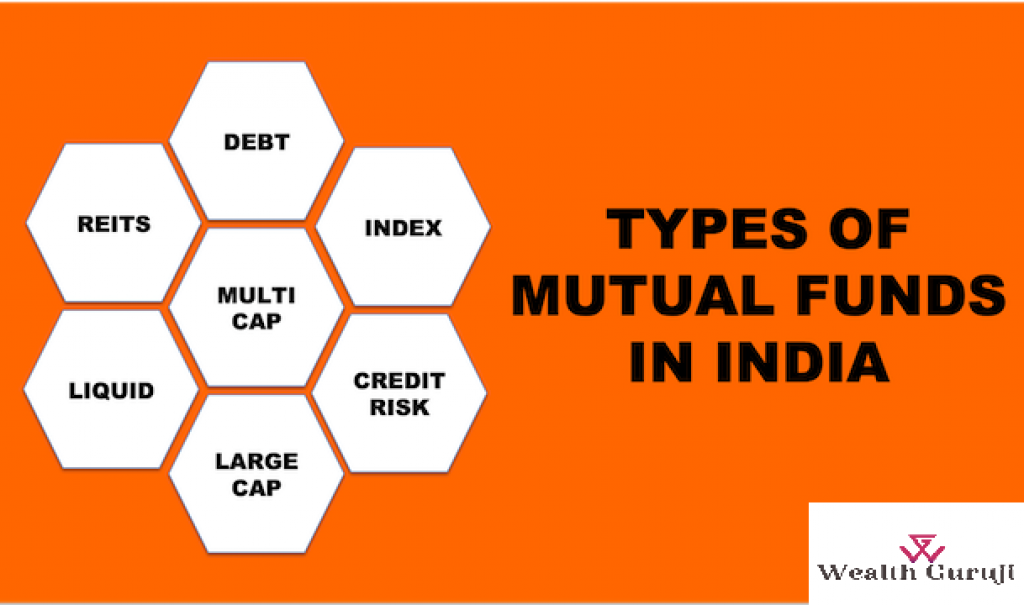

Recently, mutual funds have gained popularity as an investment option among the investors. There are different types of mutual funds available for investment and the investors can choose from them based on their return expectations and risk appetite.

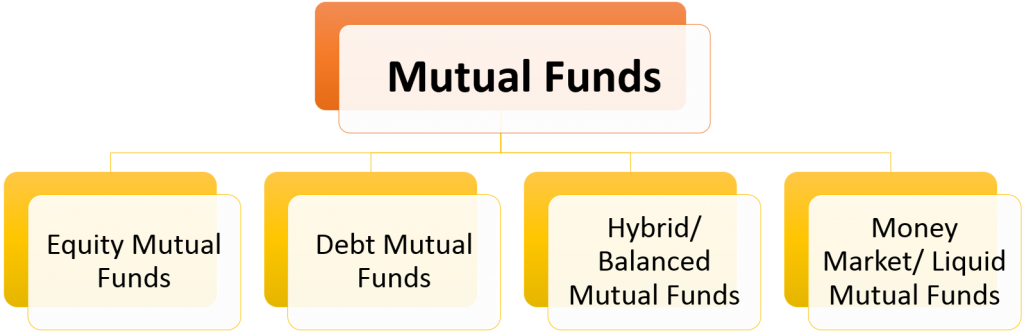

There different types of mutual funds available in the market can be classified as follows:

- Equity Mutual Funds: Equity mutual funds, also known as growth mutual funds are the ones which invest the amount pooled by the investors in the stocks or shares of the companies. Equity mutual funds have a high risk and return profile. If you want to invest for long term then it is a good option to invest in equity mutual funds.

Equity mutual funds can be further divided into four sub categories namely:- Index Funds: Index mutual funds are those that put the money of the investors in an index. These funds do not require a fund manager. The money is invested in stocks based on the weightage in the index. The returns on these funds are in line with the index they mirror. Index mutual funds can again be categorized into large-cap, mid-cap and small cap mutual funds.

- Sectorial funds: Sectorial funds are those which invest in shares of companies belonging to a particular sector like IT, FMCG, Pharma etc. The returns from these funds depend upon the performance of the particular sector to which they belong.

- Diversified funds: As the name suggests diversified mutual funds are the ones that diversify by investing in companies of different size and sector so as to minimize the risk and maximize the returns for the investors.

- Equity Linked Saving Scheme (ELSS): They are tax saving funds which invest in equities and have a lock-in period of minimum 3 years. Though they are suitable for investors with higher risk appetite, they ensure capital appreciation. They offer tax deduction under the Income Tax Act 1961.

- Debt Funds: As the name suggests, debt funds are the ones which invest in fixed income securities like bonds, debentures, liquid funds etc. which have a fixed int

- Hybrid/ Balanced Funds: Hybrid or balanced funds invest in a mix of asset classes to balance the risk and return from the portfolio. They bridge the gap between debt and equity funds however, the proportion of money invested in equity and debt may vary.

- Money Market or Liquid Funds: Money market funds invest in short term money market instruments like Treasury Bills, Certificate of deposit etc. they are suitable for investors who want to invest for a short or ultra-short time duration and are looking for moderate income along with liquidity and capital preservation.

Mutual funds can also be classified into two broad categories which are namely: open-ended funds and closed-ended funds.

Open ended funds: Open-ended funds are the ones which have no restrictions regarding the purchase or redemption. This means that the investors are free to enter and exit these funds based on their convenience.

Close-ended funds: Unlike open-ended funds, close-ended funds can be purchased only during the initial offer and cannot be redeemed before the date of maturity. These funds are listed on stock exchanges.