HindPrakash Industries Ltd. IPO (HindPrakash IPO)- Upcoming IPO 2020

In the list of upcoming IPO 2020, Hind Prakash Industries Ltd is planning to raise a fund of Rs 11.52 cr through HindPrakash IPO.HindPrakash Industries Ltd, was incorporated in the year 2008 and is based in Ahmedabad. The company is a renowned name in India which is now a diversified business conglomerate manufacturing, importing and exporting dyestuffs and other dye intermediaries.

It manufactures Reactive Dyes, Disperse Dyes, Intermediaries and Chemicals, Textile auxiliaries. The company has achieved growth in its productivity and also has expanded its range of products from just dyes to specialty chemicals.

Some of the other industries held by the group are Construction Chemicals, Specialty Chemicals, Textiles and Dyestuffs, and Dye Intermediates.

HindPrakash has three different manufacturing units located at Vatva (Gujarat), not only for manufacturing, but also for blending and formulation of textile dyes, textile auxiliaries, and intermediates. The manufacturing units have all the related machinery.

All the supply chain management from the procurement of raw materials, to manufacturing, to delivery is carried out in-house by the company.

Key Strengths:

- Supplying quality products at a reasonable price.

- Has long-term clients

- It has the advantage of being at a prime location

In this article we will highlight the following information about the company:

- Company Financials

- Company Promoters

- Objectives of the issue

- IPO Details

- Prospectus

- Contact Information

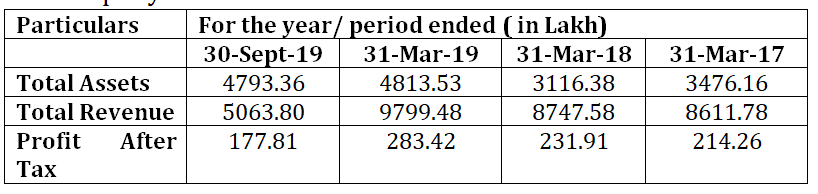

- Company Financials: Below is the glimpse of the financials of the company

- Company Promoters: Mr. Sanjay Prakash Mangal, Mr. Om Prakash Mangal, and Mr. Santosh Narayan Nambiar are the promoters of the company.

- Objects of the Issue:

- The company intends to utilize the Issue Proceeds towards the following objects:

- To meet the working capital requirements

- General corporate purpose

- To meet the issue expenses

- IPO Details: Below is all the important details related to the IPO.

| Issue Open Date | Jan 15, 2020- Jan 17, 2020 |

| Issue Type | Fixed Price Issue IPO |

| Issue Size | 2,880,000 Equity Shares of Rs.10 (aggregating up to Rs.11.52 Cr) |

| Face Value | Rs.10 per equity share |

| Issue Price | Rs.40 per equity share |

| Market Lot | 3000 shares |

| Minimum Order Quantity | 3000 shares |

| Exchanges Listed at | NSE SME |

| P/E (x) | 11.7 |

| Market Capitalization (Cr.) | 41.7 |

IPO Lot Size and Price (Retail)

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 3000 | Rs.120,000 |

| Maximum | 1 | 3000 | Rs.120,000 |

Promoters Holding

| Pre Issue Share Holding | 100% |

| Post Issue Share Holding | 27.63% |

- Prospectus

- Draft Prospectus

- Red Herring Prospectus

- Contact Information

- Corporate Address:

HindPrakash Industries Ltd.

301, Hindprakash House, Plot No. 10/6

GIDC, Vatva,

Ahmedabad- 382445, India.

Phone:

+91-79-6812 7000-10

Email: info@hindprakash.com

Website: http://www.hindprakash.in/

- HindPrakash IPO Registrar

Bigshare Services Pvt Ltd

1st Floor, Bharat Tin Works Building,

Opp. Vasant Oasis,Makwana Road,

Marol, Andheri(E), Mumbai – 400 059

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: http://www.bigshareonline.com

To get latest update on IPO visit at Upcoming IPO 2020